NexPoint Homes Trust: Single-Family Rental Opportunity

NexPoint Homes Trust, Inc. is a private real estate investment trust (REIT) that focuses on acquiring, building, operating and maintaining single-family rental homes. We target secondary and tertiary markets with well-positioned existing single-family homes and build-to-rent communities.

LEARN MORE

MARKETING MATERIALS

Client Materials

Featured Video

NexPoint Homes Trust : Single Family Rental Opportunity

NexPoint Homes Build-to-Rent

Learn More about NexPoint Homes Build-To-Rent Opportunity

NexPoint Homes in the News

“We are pleased to announce a partnership with a quality operator like HomeSource that will allow us to broaden our exposure to this critical sector and expand our SFR platform into new segments,

- Chief Investment Officer, Matthew McGraner”

NexPoint Advisors, HomeSource Launch SFR Initiative

NexPoint Announces New Single-Family Rental Initiative

OFFERING HIGHLIGHTS

NexPoint Homes is seeking to grow an existing portfolio of single-family homes through acquisition and build-to-rent communities.

Attractive Asset Class

Established Portfolio with Potential Expansion Capabilities

Experienced Management

Strong Operating Metrics

Compelling Market Fundamentals

Robust Operational Infrastructure & Platform

INVESTMENT OBJECTIVES

Maximize Cash Flow and Value of Properties Owned

Acquire or Develop Properties with Cash Flow Growth Potential

Provide Quarterly Cash Distributions

Create Long-Term Capital Appreciation

OFFERING OVERVIEW

Structure1 |

Private Real Estate Investment Trust (REIT)| Reg. D offering for accredited investors only | UPREIT Structure |

Offering Size2 |

$2.5 Billion or up to 100,000,00 Shares* |

Minimum Investment |

$25,000 |

Term |

5 years with two one-year extension options (at discretion of board) |

Distributions3 |

Annualized distributions based on NAV; paid quarterly |

*There can be no assurance that these objectives will be realized or that a loss of capital will be avoided. | 1. UPREIT structure is comprised of a REIT and an operating partnership, which through single purpose entities owns and operates the properties. | 2. $2.5 Billion is based on a share price of $25 multiplied by 100,000,000 shares | 3. Distributions are not guaranteed and may be suspended, modified or terminated at the discretion of the Board of Directors. Distributions may be paid from offering proceeds and may include a return of capital or borrowed funds, which may lower overall returns to the investor any may not be sustainable.

THE SINGLE-FAMILY RENTAL SECTOR

7.4 Million

Shortage of Affordable Price Homes

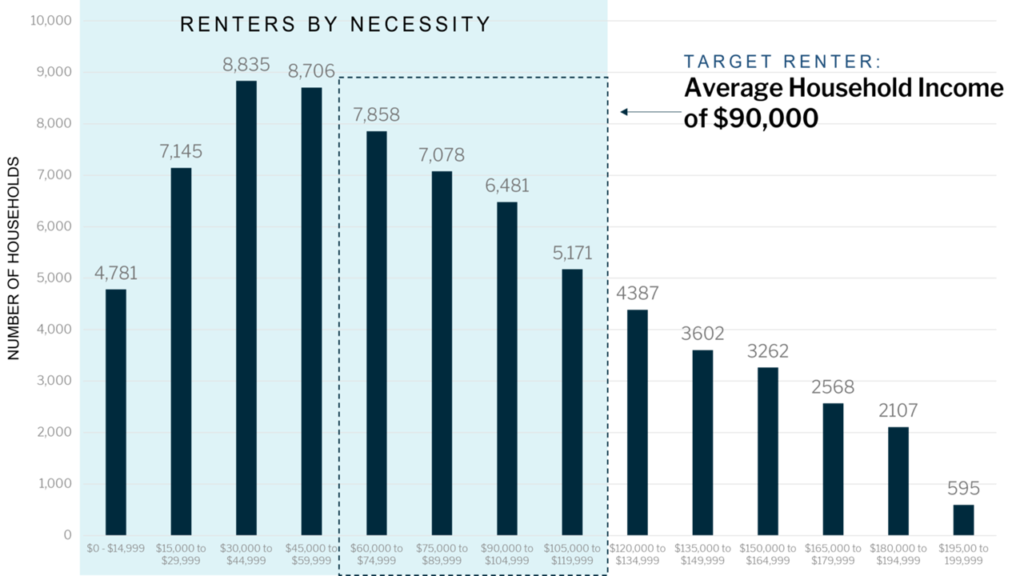

Renters by Necessity: A Growing Demographic

U.S. homeownership rates remain well below their peak levels with more Americans unable to afford purchasing a starter home due to the high barriers to homeownership.

Supply and Demand Imbalance

The single-family rental (SFR) market is the single largest segment of the rental market by valuation and households served. While over 4 million SFRs have been added since the Great Recession, America is massively underbuilt in the workforce price point where there is a shortage of 7.4 million affordably priced homes.

1 Green Street Advisors Advisory & Consulting Group, February 2021. 2 Freddie Mac, Spotlight on Underserved Markets, 2018 and National Low Income Housing Coalition, 2019.

Down payments remain an obstacle and the #1 financial hurdle for single-family renters who would prefer to own rather than rent.1

Circumstances Causing Single-Family Renters Who Would Prefer to Own to Rent1

Down Payment

Need to Improve Credit Score

Cannot Afford Location

Not Earning Enough

Housing Market Conditions

Too Much Debt

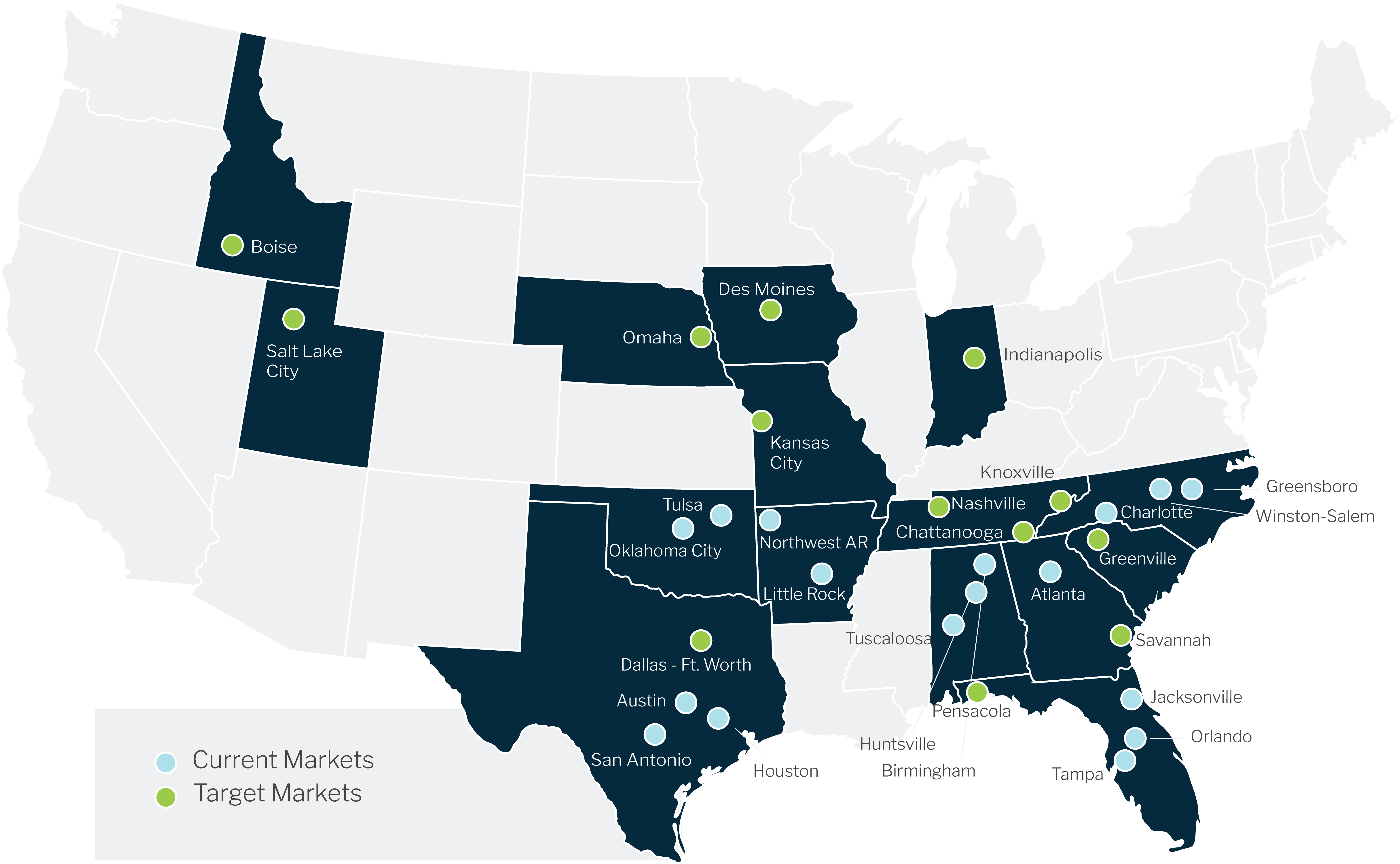

THE STRATEGY

Targeting Existing Home Acquisitions and Build-to-Rent Homes in Underserved Secondary and Tertiary Markets.

With an initial portfolio of over 1,200 single-family rental homes and $216 million in seed capital and a $240 million credit facility, NexPoint Homes is targeting newer vintage single-family rental homes and build-to-rent (“BTR”) homes in secondary and tertiary markets.

Using a balanced rehabilitation model and carefully studying the Affordability Index of the geographical area, we price these rentals more affordably regardless of market comparable, aiming to provide more affordable housing in safe neighborhoods near major employment centers.

Average Purchase Price

$250,000

Average Monthly Rent

$1,600

Average SQFT

1,500 – 2,500

Average Bed/Bath

3 Bedroom 2 Bath

Existing SFR vs BTR

60% SFR, 40% BTR

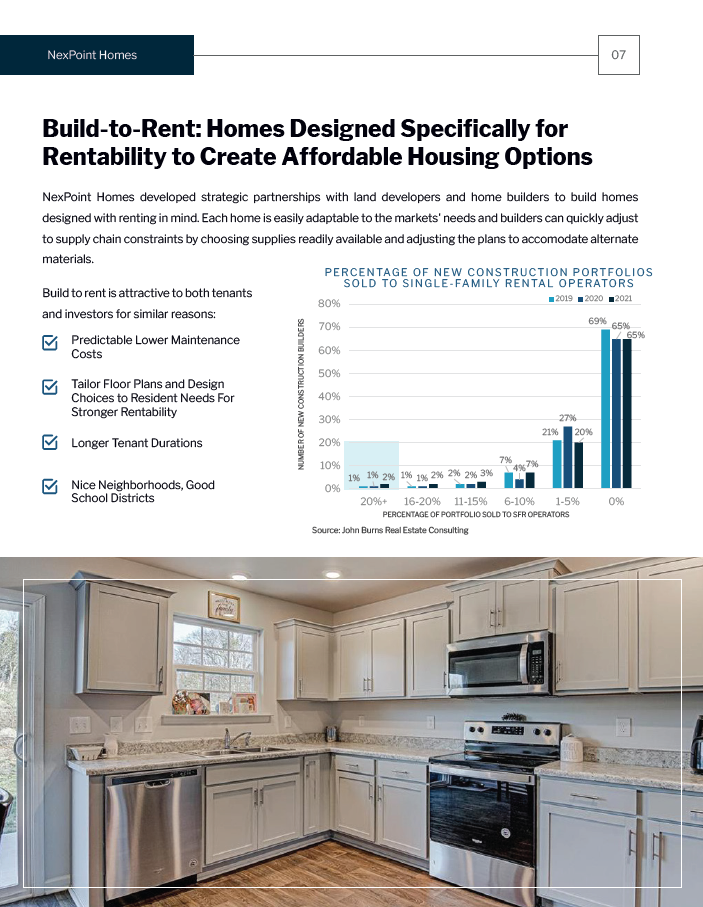

BUILD-TO-RENT

Homes Designed Specifically for Rentability to Create Affordable Housing Options

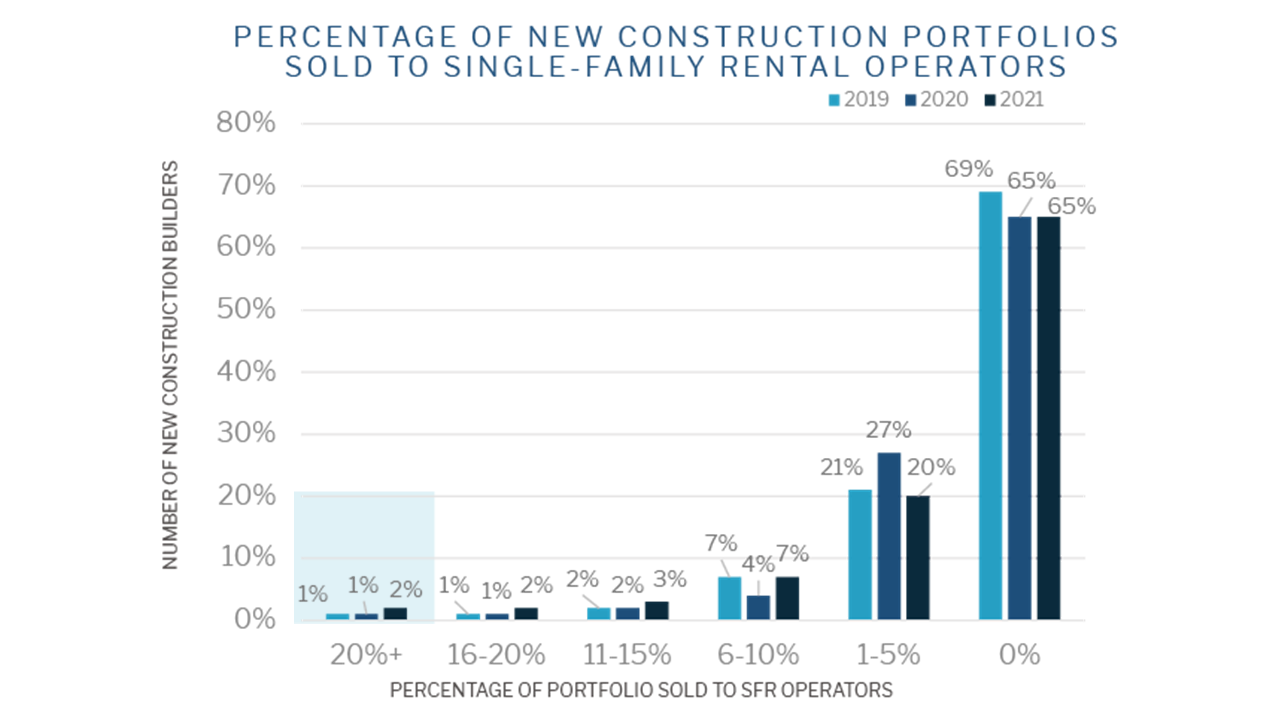

NexPoint Homes developed strategic partnerships with land developers and home builders to build homes designed with renting in mind. Each home is easily adaptable to the markets’ needs and builders can quickly adjust the supply chain constraints by choosing supplies readily available and adjusting plans to accommodate alternative materials.

Build to rent is attractive to both tenants and investors for similar reasons:

Source: John Burns Real Estate Consulting

EXPERTS IN REAL ESTATE

NexPoint Management Team

Matthew McGraner

Chief Investment Officer

Mr. McGraner is a member of the investment committee for the Sponsor and serves numerous roles across the NexPoint platform. With over ten years of real estate, private equity and legal experience, his primary responsibilities are to lead the strategic direction and operations of the real estate platform at NexPoint. acquisitions. Mr. McGraner has led the acquisition and financing of approximately $16.5 billion of real estate investments.

Brian Mitts

Chief Financial Officer

Mr. Mitts is a member of the investment committee for the Sponsor and serves numerous roles across the NexPoint platform. Currently, Mr. Mitts leads NexPoint’s financial reporting and accounting teams and is integral in financing and capital allocation decisions. Mr. Mitts was also a cofounder of NREA, as well as NXRT and NexPoint Advisors, L.P., the parent of NREA. He has worked for NREA or one of its affiliates since 2007.

Paul Richards

Director, Real Estate

Mr. Richards is a Director, Real Estate at NexPoint Advisors, LP. His primary responsibilities are to research and conduct due diligence on new investment ideas, perform valuation and benchmark analysis, monitor and manage investments in the existing real estate portfolio, and provide industry support for NexPoint’s Real Estate Team. He was previously a Product Strategy Associate and was responsible for evaluating and optimizing the registered product lineup.

EXPERTS IN REAL ESTATE

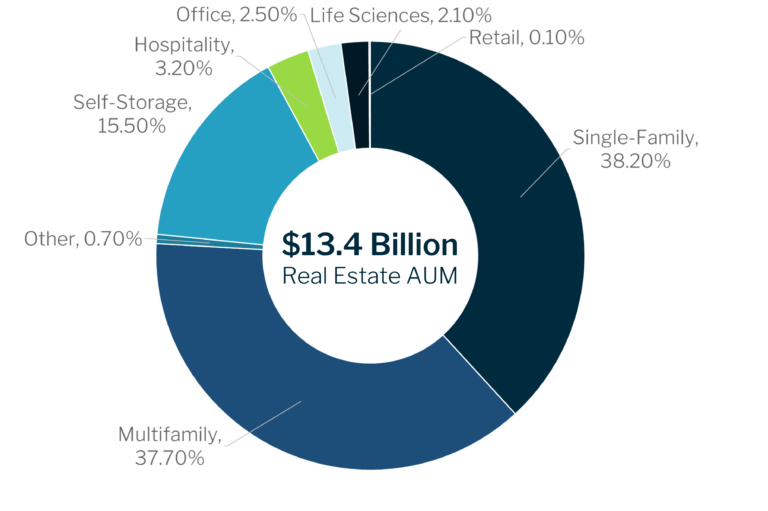

NexPoint Real Estate Track Record

$18.4 Billion

In Gross Real Estate Acquisitions2

$3.3 Billion

Real Estate Transactions in the Last 12 Months2

324

Real Estate Acquisitions2

34

States Nationwide

1.93x

Multiple of Invested Capital2

$1,183.30 Million

Realized Value Total2

32.5%

Gross IRR

70

Realized Investments

Asset Mix1

1Real estate assets as of December 31, 2022, inclusive of affiliates.

2Real estate assets acquired from January 1, 2012 to December 31, 2022, inclusive of affiliates.

THE OPERATOR

HomeSource Operations, LLC

“What began as a journey to provide quality single-family rental homes, has grown into a celebration of contemporary design and thriving communities. We're working with the most seasoned property management experts to create places that give you and your family room to grow.”

Randy HagerdornCEO & Co-Founder

Meet The Team

Randy Hagedorn

CHIEF EXECUTIVE OFFICER

Mr. Hagedorn has served as a member of our Board since June 8, 2022, is a member of the Investment Committee and is the chief executive officer and co-founder of the Manager. Mr. Hagedorn is an industry veteran in the single-family rental space with investment and operating expertise. Most recently, Mr. Hagedorn helped Lennar (NYSE:LEN) craft and launch its single-family initiative. Mr. Hagedorn has also been responsible for the development and implementation of a nationwide acquisition and disposition strategy for Tricon Residential Inc. (TSX:TCN). Under his guidance, Tricon acquired +9,000 homes for $1.4B through the acquisition of Silver Bay (NYSE:SBY) in mid-2017 and organically grew the portfolio to nearly 20,000 homes.

Adam Levinson

CHIEF INVESTMENT OFFICER

Mr. Levinson is the chief investment officer and co-founder of the Manager and an industry pioneer in the single-family rental industry. During his career, he has acquired, renovated, and sold over 15,000 homes and played a key role in the acquisition of over $1B in assets. Prior to the Manager, he co-founded Street View Properties, a fund focused on acquiring assets below replacement cost in target markets and repositioning those assets to sell via the retail channel to end users and/or investors.

Rich Scola

CHIEF INVESTMENT OFFICER

Mr. Scola is a member of the Investment Committee and is chief operating officer and co-founder of the Manager and has been involved in the single-family rental space for over a decade, in a variety of leadership roles. Prior to the Manager, he co-founded Street View Properties, a fund focused on acquiring assets below replacement cost in target markets and then repositioning those assets to sell via the retail channel to end user owner occupants and/or investors.

Disclosures and Risk Factors

This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any securities will be offered only by means of a Confidential Private Placement Memorandum (“Memorandum”) provided to a limited number of accredited investors.

This document has been prepared by NexPoint Homes Trust, Inc. (“NexPoint Homes ”, the “Company”, or “We”) to provide preliminary information about the offering (“the Offering”) of shares of the Company’s Class A common stock and Class I stock (the “shares”). Some of the information contained in this document is non-public, confidential and proprietary in nature and may constitute trade secrets under applicable law with respect to the Offering, NexPoint Homes and the investments made by NexPoint Homes and its affiliates, the disclosure of which could have material adverse effects on the Offering, the Company or the Company’s respective investments and affiliates.

Investing in the Company involves a number of significant risks and other important factors relating to investments in real estate generally, and relating to the strategy and investment objectives of the Company in particular.

Prospective investors should carefully consider the following risk factors, together with all of the other information (including risk factors) included in the Memorandum before deciding to purchase Shares. As a result of these factors, as well as other risks inherent in any investment, there can be no assurance that the Company will be able to meet its investment objectives or otherwise be able to successfully to carry out its investment program.

An investment in the Company is not a direct investment in real estate, but rather an investment in a REIT that owns single family rental assets.

GENERAL REAL ESTATE RISKS. The Company will be subject to the risks incident to the ownership and operation of real estate, including risks associated with the general economic climate, local real estate conditions (including the availability of excess supply of properties relative to demand), changes in the availability of debt financing, credit risk arising from the financial condition of tenants, buyers, and sellers of properties, geographic or market concentration, competition from other spaces, government regulations, fluctuations in interest rates and various other risks. The Company or its subsidiary entities will incur the burdens of ownership of real property, which include paying expenses and taxes, maintaining the investments, and ultimately disposing of the Portfolio.

LIMITED LIQUIDITY AND TRANSFERABILITY OF SHARES. There is no public market for the shares and no such market is expected to develop in the future unless the Company successfully conducts an initial public offering or listing on a national exchange. As a result, investors in the Company may be required to hold their shares for the entire term of the Company. Consequently, the purchase of shares should be considered only as a long term and illiquid investment and Shares should only be acquired by investors who are able to commit their funds for an indefinite period of time.

FACTORS IMPACTING THE SINGLE-FAMILY RENTAL (“SFR”) MARKET. Our investment strategy is premised on assumptions about occupancy levels, rental rates, interest rates, supply and demand, acquisition and operating costs and other factors in the SFR market. If those assumptions prove to be inaccurate, our cash flows and profitability will be reduced. A softening of the rental market in our core areas would reduce our rental revenue and profitability.

LEVERAGE. The Company may continue to utilize leverage or enter into hedging agreements related to its debt in connection with its respective investments. Significant borrowings increase the risks of an investment in the Company. If there is a shortfall between the cash flow from investments and the cash flow needed to service the Company’s indebtedness, then the amount available for distributions to stockholders may be reduced. In addition, incurring mortgage debt increases the risk of loss because defaults on indebtedness secured by a property may result in lenders initiating foreclosure actions.

POTENTIAL CONFLICTS OF INTEREST. Certain employees of NexPoint Real Estate Advisors XI, L.P. (the “Adviser”) and HomeSource Operations LLC (the “Manager”) will have conflicts of interest in allocating their time between the Company and their other business activities. Additionally, affiliates of the Adviser and the Manager own and operate and may continue to own and operate, in the future, other properties outside the Portfolio, which may result in a conflict of allocation of services and costs.

We may pay distributions from sources other than our cash flow from operations, including, without limitation, the sale of assets, borrowings or offering proceeds (including from sales from our common stock or limited partnership units (“OP Units”) to affiliates of NexPoint ), and we have no limits on the amounts we may pay from such sources. Funding distributions from such sources will result in us having less funds available to acquire SFR properties or other real estate related investments. As a result, the return you realize on your investment may be reduced. Likewise, funding distributions from the sale of additional securities will dilute your interest in us on a percentage basis and may impact the value of your investment, especially if we sell these securities at prices less than the price you paid for your shares. To the extent we borrow funds to pay distributions, we would incur borrowing costs and these borrowings would require a future repayment. The use of these sources for distributions and the ultimate repayment of any liabilities incurred could adversely impact our ability to pay distributions in future

periods, decrease our Net Asset Value (“NAV”), decrease the amount of cash we have available for operations and new investments and adversely impact the value of your investment.

The Advisor acts as the adviser to the Company and is the sole sponsor of the Offering. The Adviser is a wholly owned subsidiary of NexPoint Real Estate Advisors, L.P. (“NREA”). NREA is wholly owned by NexPoint Advisors, L.P. (“ NexPoint ”). Past performance does not guarantee future results. Performance during time periods shown is limited and may not reflect the performance in difference economic and market cycles. There can be no assurance that similar performance will be experienced. Investing in the Company involves a number of significant risks and other important factors relating to investments in companies generally, and relating to the strategy and investment objectives of the Company in particular. Prospective investors should carefully consider the foregoing risk factors, together with all of the other risk factors and information included in the Memorandum, before deciding to purchase shares. As a result of these factors, as well as other risks inherent in any investment, there can be no assurance that the Company will be able to meet its investment objectives or otherwise be able to successfully to carry out its investment program.

NexPoint Securities, Inc., member FINRA/SIPC, is the dealer manager for the NexPoint Homes Trust, Inc. offering.