INTRODUCING

NexPoint Storage I DST

NexPoint believes that this portfolio of self-storage properties presents an attractive long-term investment opportunity due to favorable submarket demographics, nearby retail drivers, continued and strengthening demand for self-storage, superior quality of each asset, high physical occupancy of the portfolio and long-term strength of sector.

| Total Acquisition Cost* | $142,947,366 |

| Supplemental Reserves | None |

| Lender Reserves** | $2,931,426 |

| Total Capitalization | $150,892,414 |

| Offering Size | $85,892,414 |

| Minimum Purchase – Cash | $100,000 |

| Minimum Purchase – 1031 | $100,000 |

| Suitability | Accredited Investors Only |

| Loan Amount | $65,000,000 |

| Loan to Value | 43.08% |

| Interest Rate | 3.99% Fixed Rate |

| Loan Term | 10 Years |

| Amortization | Interest Only for Full Term |

* The Total Acquisition Cost is the Real Estate Acquisition Price, the Contribution Fee, the Acquisition Closing Costs and the Financing Closing Cost.

** Lender Reserves refers to the Earn-Out Reserve in addition to the Tax and Insurance Reserve. There are substantial risks in any investment program. See “Risk Factors” on page 24 of the PPM for a discussion of the risk relevant to the Offering.

Distributions are not guaranteed.

The forecasted distribution rates are only estimates based on the specific assumptions more fully described in the PPM. There is no guarantee that the assumptions used in the projection will be achieved. Please review the entire PPM prior to investing. This material does not constitute an offer and is authorized for use only when accompanied or preceded by the PPM. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All potential Purchasers must read the PPM and no person may invest without acknowledging the receipt and complete review of the PPM.

According to the Self Storage Association, a not-for-profit trade association representing the self-storage industry, the self-storage industry has been the fastest growing segment of the commercial real estate industry over the last 40 years. The demand for self-storage continues to strengthen as healthy job growth, rising wages and the formation of new households support the need for self-storage.

The Properties are of superior quality (multi-story, secure, predominately climate controlled), age (latest generation, less than five years old) and location (urban core, high density and strong demand drivers) of each facility referred to as Generation V or GenV Facilities.

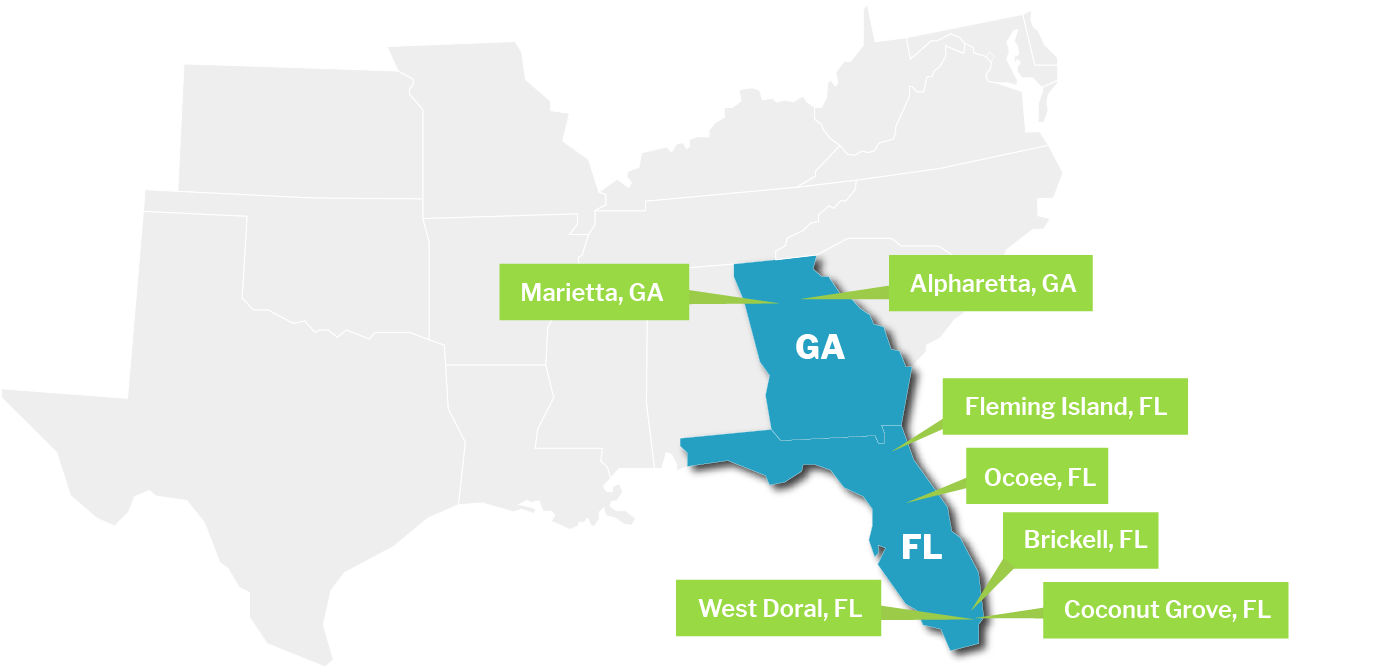

The Properties are located in four major United States MSAs: Miami, Atlanta, Orlando, and Jacksonville exhibiting above-average population and job growth over the past five years, are large international cities and contain many of the demand drivers that produce high occupancies and rental rates for self-storage facilities.

Each of the Properties is managed by Extra Space Management, Inc. (“EXR”), an affiliate of a leading owner and operator of self-storage properties utilizing state-of-the art revenue management systems, experienced data scientists, leading digital marketing techniques and many years of self-storage experience to maximize returns.

NexPoint believes that GenV Facilities in top 50 United States MSAs can be expected to perform better over time and create more value than facilities in smaller markets and older generation facilities, wherever located.

Miami: In Miami, jobs continue to be added, residents and visitors keep coming, and the port systems will continue delivering high-value cargo around the globe.

Atlanta: Atlanta’s diverse and strong economy will lead to continued moderate expansion and provide a foundation for strong commercial real estate fundamentals.

Orlando: Taking advantage of its central location, Orlando is emerging as a place of high-tech manufacturing and as a distribution hub, moving into second place in terms of large market economic growth within the state and is on a path for future gains.

Jacksonville: Capital improvements to Jacksonville’s port systems and regional expressway upgrades should provide a boost to construction jobs and improve infrastructure to encourage economic expansion.

Brickell, West Doral, and Coconut Grove Properties

Employment Growth Year-over-Year

Avg. Personal Income Growth each of the last 3 Years

Projected Annual Growth Rate Over Next Several Years

Jobs Added in Transportation, Warehousing and Utilities Industries 3.8% increase Year-Over-Year

Gross Metro Product rose 16% since 2014

Marietta and Alpharetta Properties

YoY Employment Growth*

Median Household income growth projected between 2020 and 2015**

Projected population growth rate between 2020 and 2025, ~87,775 residents per year**

Jobs added between 2018 and 2019, a 2.3% increase YoY – 25.2% increase since 2010*

Gross Metro Product as of 2019 – rose by 32% since 2014***

*Source: Bureau of Labor Statistics, Current Employment Survey (CES). Data is not seasonally adjusted.

** Source: Esri 2020. Compiled by JLL Valuation & Advisory Services, LLC.

***Source: U.S. Bureau of Economic Analysis

Ocoee Property

Non-Agricultural Employment Growth Year -over-Year

Avg. Personal Income Growth each of the last 3 Years

Projected Annual Growth Rate Over Next Several Years

Jobs Added ~4,900 Construction Jobs Added Year-over-Year and 12,100 jobs since 2018, a 7.4% gain

Gross Metro Product rose 21.8% since 2014

Fleming Island Property

Employment Increase Year-over-Year

Avg. Personal Income Growth each of the last 3 Years

Projected Annual Growth Rate Over Next Several Years

Jobs Added YoY. 9,400 Jobs Added in Professional and Business Services and 6,300 in Professional, Scientific, and Tech Services

Gross Metro Product rose 19.8% since 2014

Data as of March 31, 2021

Miami-Ft. Lauderdale-Pompano Beach, FL is the seventh largest MSA in the country that has recently experienced moderate population growth of 10.82% from 2010 to 2019.

1103 SW 3rd Avenue

Miami FL 33130

Avg. Household Income

Renter Occupied

The Brickell Property sits less than a half mile from downtown Miami. The submarket has excellent population metrics both in terms of current population and annual population growth. The Brickell Property is in close proximity to high-end, multifamily developments whose residents make for great self-storage tenants.

590 NW 137th Ave

Miami, FL 33182

Avg. Household Income

Renter Occupied

The West Doral Property sits roughly 15 miles to the west of downtown Miami in the suburb of West Doral, FL. The most intriguing aspect of the West Doral Proprty is its lack of competitive supply.

2434 SW 28th Ln

Miami, FL 33133

Avg. Household Income

Renter Occupied

The Coconut Grove Property sits just over three miles from downtown Miami. The population metrics make the Coconut Grove Property attractive.

Atlanta-Sandy Springs-Alpharetta, GA is a primary MSA and ninth largest in the country that has recently experienced strong population growth of 13.88% from 2010 to 2019.

340 Franklin Gateway SE

Marietta, GA 30067

Avg. Household Income

Renter Occupied

The Marietta Property sits roughly 15 miles to the northwest of downtown Atlanta in the suburb of Marietta, GA. The Marietta Property’s visibility on 1-75 and its proximity to heavily-trafficked retail areas make it appealing.

5110 McGinnis Ferry Road

Alpharetta, GA 30005

Avg. Household Income

Renter Occupied

The Alpharetta Property is located approximately 25 miles to the northeast of downtown Atlanta in the affluent suburb of Alpharetta, GA. The Alpharetta Property boasts a close proximity to high income neighborhoods and the high annual population growth.

11920 W. Colonial Drive

Ocoee, FL 34716

Avg. Household Income

Renter Occupied

The Ocoee Property site sits just over ten miles from downtown Orlando. Orlando-Kissimmee-Sanford, FL is the 23rd largest MSA in the country. Orlando is a primary MSA that has recently experienced excellent population growth of 22.20% from 2010 to 2019. The most intriguing aspects of the Ocoee Property are the great visibility, easy access and the strong population growth of the submarket.

1939 East West Parkway

Fleming Island, FL 32003

Avg. Household Income

Renter Occupied

The Fleming Island Property sits just over 16 miles from downtown Jacksonville. Jacksonville, FL is the 40th largest MSA in the country, a smaller primary MSA that has recently experienced strong population growth of 15.90% from 2010 to 2019. Factors that make the Fleming Property attractive include a lack of competition, strong incomes and good population growth.

1.Esri

2. Apartments.com

CEO, NexPoint Storage Partners

Mr. Good is the CEO and a member of the board of directors of NexPoint Storage Partners. Mr. Good lends his many years of real estate, legal, investment, and capital markets experience to the broader NexPoint platform in a senior advisory capacity. Mr. Good has been in the REIT and financial services industries for nearly three decades. Prior to joining NexPoint, Mr. Good was Chairman and CEO of Jernigan Capital, Inc., a NYSE-listed self-storage REIT.

President

Mr. McGraner is a member of the investment committee for the Sponsor and serves numerous roles across the NexPoint platform. With over ten years of real estate, private equity and legal experience, his primary responsibilities are to lead the strategic direction and operations of the real estate platform at NexPoint. acquisitions. Mr. McGraner has led the acquisition and financing of approximately $11.2 billion of real estate investments.

Chief Financial Officer, Secretary, and Treasurer

Mr. Mitts is a member of the investment committee for the Sponsor and serves numerous roles across the NexPoint platform. Currently, Mr. Mitts leads NexPoint’s financial reporting and accounting teams and is integral in financing and capital allocation decisions. Mr. Mitts was also a cofounder of NREA, as well as NXRT and NexPoint Advisors, L.P., the parent of NREA. He has worked for NREA or one of its affiliates since 2007.

NexPoint Storage Partners is a self-storage real estate investment group created through NexPoint’s take-private acquisition of Jernigan Capital Inc. (“JCAP”). NexPoint Storage Partners builds on the original mission of JCAP to invest in newly built, multi-story, climate-controlled, Class-A self-storage facilities known as GenV Facilities located in dense and growing markets throughout the United States.

Class A, Newly Built GenV Facilities

Strategically Selected Submarkets

Years of Self-Storage Growth and Development

The NexPoint Storage Partners’ broader portfolio was developed from the ground up with entrepreneurial developers having substantial experience in selecting, acquiring, and entitling sites for self-storage development. 96% of our facilities are located within the top 50 U.S. MSAs and 82% are located within the top 25 U.S. MSAs.

Since early 2015, NPSP (and JCAP) has underwritten over $12 billion of prospective self-storage investment and developed a best-in-class portfolio of GenV Facilities. The self-storage platform has grown from a blind pool of $110 million of initial capital on April 1, 2015, to an investment portfolio valued today at greater than $1 billion.

The Property Manager’s (i.e. Extra Space Management, Inc.) size and scale give it increased data, better decision-making abilities, and more efficient cost structures. It is able to leverage its scale and make informed decisions that ultimately benefit its partners’ properties. At the same time, it is not so big that it can’t work locally with the 650+ properties it manages in 40 states.

Properties

States

All Properties in the Offering are managed by Extra Space Management, Inc., an affiliate of a self-administered and self-managed REIT and a member of the S&P 500, headquartered in Salt Lake City, Utah.

Extra Space Storage, Inc.’s properties comprise approximately 1,010,000 units and over 585M square feet of rentable storage space. It offers customers a wide selection of conveniently located and secure storage units across the country, including boat storage, RV storage and business storage.

Professional Managers

Over 1,850 Convenient Locations

State-of-the-Art Security

Clean and Well-Lit

Variety of Sizes

Climate-Controlled Units

There are substantial risks in any investment program. See “Risk Factors” on page 24 of the accompanying PPM for a discussion of the risk relevant to this offering. Distributions are not guaranteed. The forecasted distribution rates are only estimates based on the specific assumptions more fully described in the PPM. There is no guarantee that the assumptions used in the projection will be achieved. Please review the entire PPM prior to investing. This material does not constitute an offer and is authorized for use only when accompanied or preceded by the PPM. Reference is made to the PPM for a statement of risks and terms

of the offering. The information set forth herein is qualified in its entirety by the PPM. All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM.

An investment in an Interest is highly speculative and involves substantial risks including, but not limited to:

NexPoint Securities, Inc., an entity under common control with the Sponsor, serves as the Managing Broker-Dealer of the offering. The Managing Broker-Dealer was formed in November 2013 and is registered as a broker-dealer with the Securities and Exchange Commission and is a member of FINRA/SIPC.

PLEASE CONTACT YOUR ADVISOR WITH ANY QUESTIONS ABOUT THIS OFFERING.